Updated January 8, 2024

Business cycles are the fluctuations in national income and unemployment. Before the Great Depression, economists had been debating whether or not the government could use monetary and fiscal policy to fight recessions. The mainstream classical school of economics did not have a consensus about why business cycles happened nor how governments could reduce recessions. There were even some economists like Fredrich Hayek who believed that recessions were a healthy part of capitalism and should not be avoided, but rather that monetary policy should keep interest rates high to avoid periods of excessively high economic growth!

The Keynesian revolution in economics was inspired by the calamity of the Great Depression, but Keynes did not publish this General Theory until1936 and it took some time to become mainstream, so it was too late to influence the policies of the Great Depression. The debate over Keynesianism created the discipline of macroeconomics as a distinct specialty separate from other parts of economics. Although the Keynesian revolution was too late to influence the policies of the Great Depression, it would have supported many of the fiscal and monetary stimulus programs of the FDR administration.

In fact, FDR was also influenced by classical economists who convinced him to slash government spending by 17 percent the year Keynes’ theory was published! The US economy had been recovering rapidly when FDR was implementing fiscal and monetary stimulus from 1933-36, but it tipped back into recession in 1937 with FDR’s return to austerity. FDR’s fiscal stimulus was actually fairly small as a percent of GDP and he cut it way too early: Unemployment had not even dropped below 15% and the premature return to austerity prolonged the depressed economy.

Then WWII brought the biggest increase in government spending in US history in 1940. That mammoth fiscal stimulus rapidly reduced unemployment and finally ended the Great Depression for good.

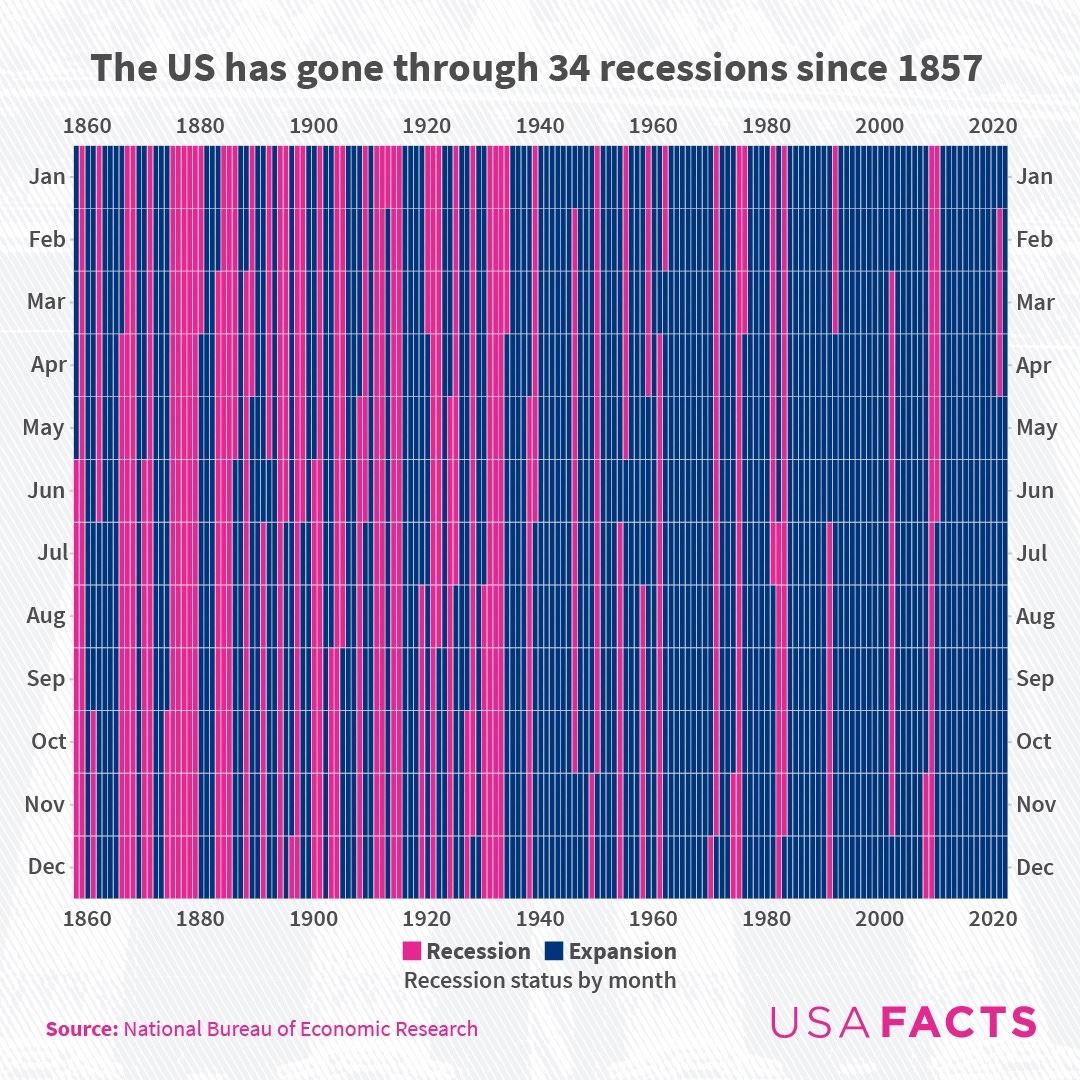

Over the following decades, the US government followed the monetarist prescription and focused on Keynesian monetary policy and the US never intentionally implemented a Keynesian fiscal stimulus until 2008. But monetary became very active at constantly trying to fine tune the economy after leaving the gold standard and it worked! Recessions became less frequent:

Fiscal policy was never deliberately used for fighting a recession until 2008* partly because it was still remarkably controversial even in 2008, but for some reason, most critics of fiscal policy accepted the routine use of monetary policy to steer the economy. One major exception was the proponents of returning to the gold standard. Although about 98% of economists rejected them, they were a substantial percentage of the US population and some major politicians supported the idea. The gold standard eliminates most of the tools of monetary policy because it forces the central bank to try to stabilize the value of gold to avoid excessive inflation and deflations produced by changes in the international supply and demand of gold. Stabilizing the throes of the market value of gold/money is an extremely challenging task which consumes nearly all of the efforts of monetary policy under a gold standard. Many of the proponents of the gold standard were ideologically-motivated libertarians who dislike the politics of giving power to the government to set the interest rate and inflation rate. The central planners at the Fed literally set the price of money and manipulate the unemployment rate! They manipulate what share of our national income goes to workers versus how much goes to capital owners in the form of interest! This would seem much more politically controversial than fiscal policy which is just deciding how much the government borrows from year to year.

Since the advent of bitcoin, many of the libertarians who used to support the gold standard have switched to dreaming about a cryptocurrency replacing the Fed, but this has been so impractical so far that the idea has not generated nearly as much support from mainstream politicians as the gold standard which was proposed by major presidential candidates, state governors, and senators until 2008 whereupon the invention of cryptocurrency in 2009 fragmented the allegiances of the people who want to end the Fed.

So the first Keynesian fiscal stimulus bill in US history was George W. Bush’s 2008 Economic Stimulus Act which sent $600 checks to most low and middle-income households. The Bush stimulus contributed $152B of stimulus and was followed up in 2009 by Obama’s ARRA stimulus which totaled $831B over ten years. About 1/3 of Obama’s stimulus was tax cuts and 2/3 spending. The Obama stimulus was extremely politically contentious and inspired a backlash by a vocal minority who believed Keynes was wrong. They typically believed in some version of classical macroeconomics–that recessions are solely caused by changes in aggregate supply which cannot be improved by fiscal stimulus. There were many people who claimed that Obama’s stimulus would not work or that it would make the economy worse. On the other side of the debate, many Keynesian economists argued that it was far too small to fix the enormous economic problem and should have been at least double the size.

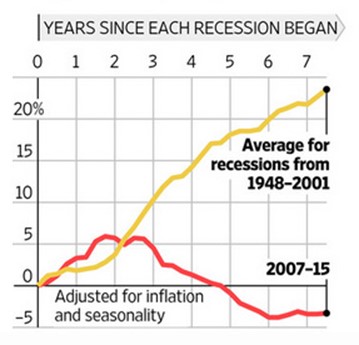

In fact, the Obama stimulus was extremely weak given all the other government spending that was declining. It mostly just replaced cuts in other government spending because total government spending (including state + local + federal) only increased at about the same rate as in all prior recessions for the first two years of the stimulus, and then plummeted due to other cuts, many of which were implemented by state or local governments.

There is always some automatic fiscal stimulus in every recession because income tax revenues fall as incomes fall and welfare payments (mostly unemployment assistance) automatically increase as incomes fall so the government automatically increases deficit spending without changing policy. But that is just accidental fiscal stimulus and not an intentional change to stimulate the economy.

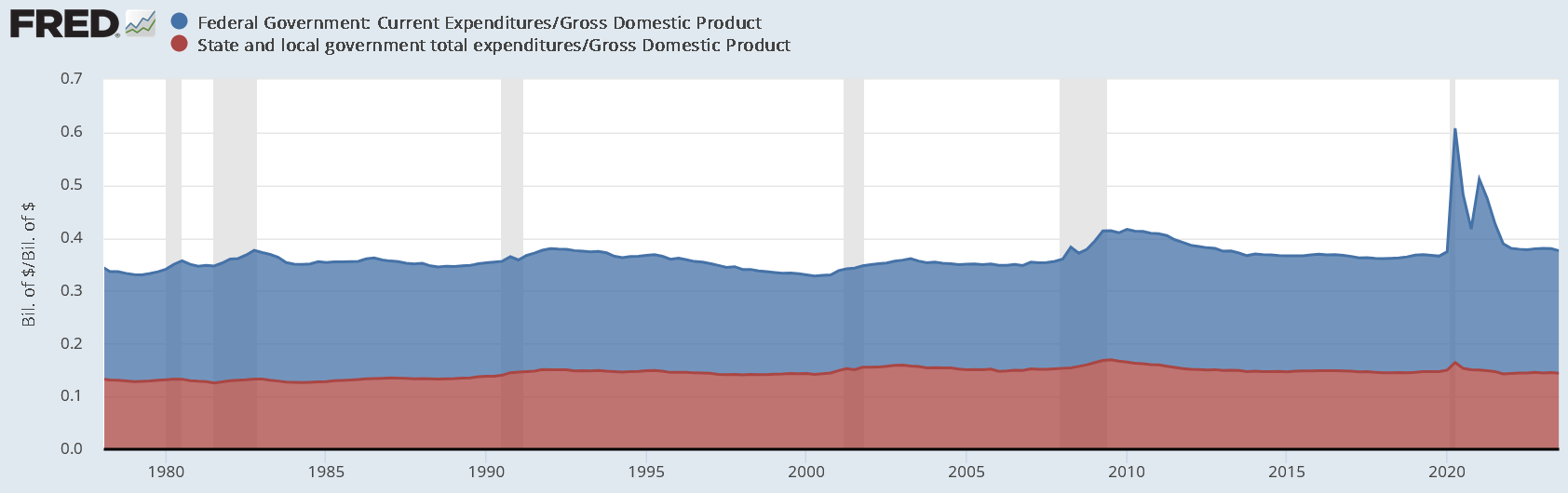

The graph below shows the increases in government spending during recessions which shows how much bigger the 2020 spending increase was than any other since WWII:

The fiscal austerity that began in 2010 was similar to FDR’s 1946 austerity. Both were premature and contributed to a VERY slow recovery. In fact, unemployment did not return to its pre-recession low until 2017, an entire decade after the recession began.

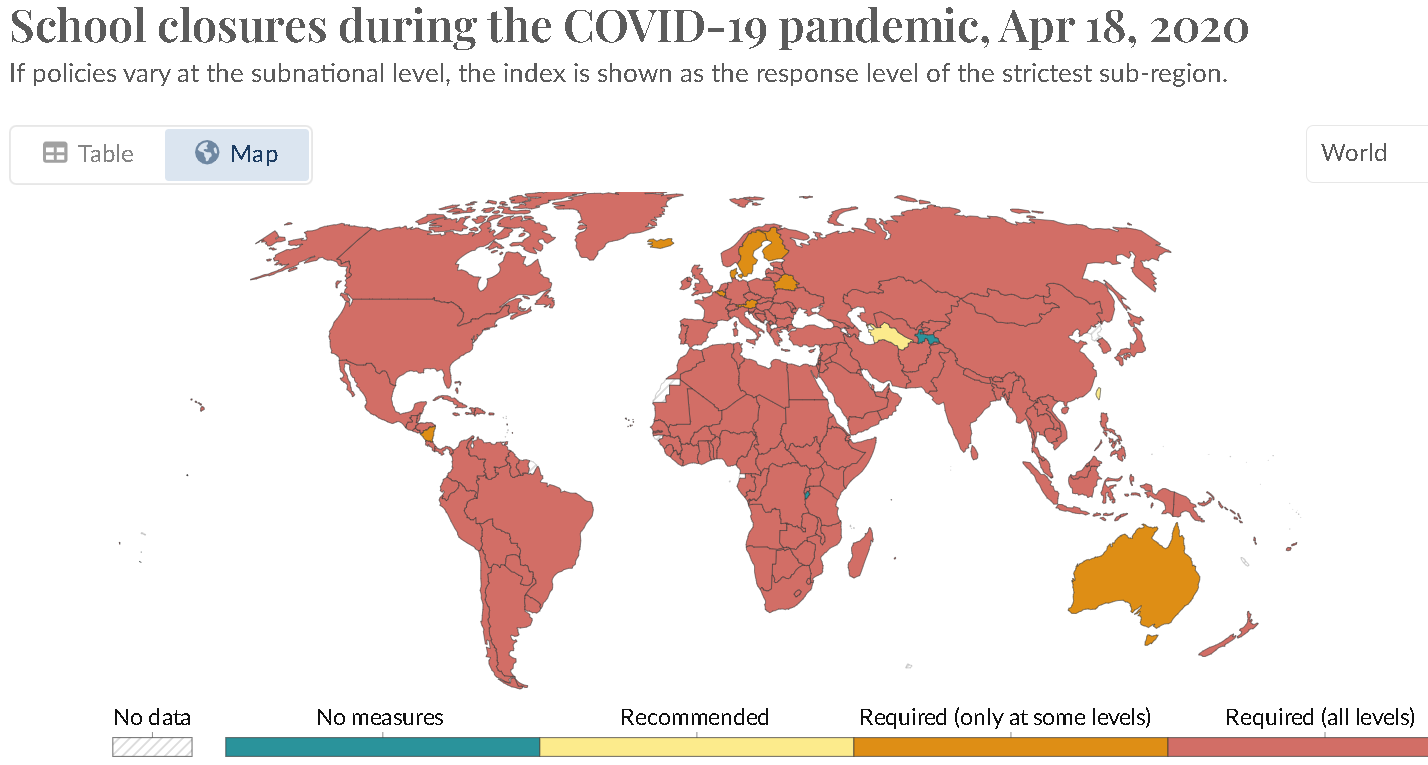

The 2020 pandemic recession was an enormous global economic shock

The 2020 pandemic led to a global shutdown. Every nation closed schools at some point with the peak in April, but shutdowns continued for almost two years in some parts of the world.

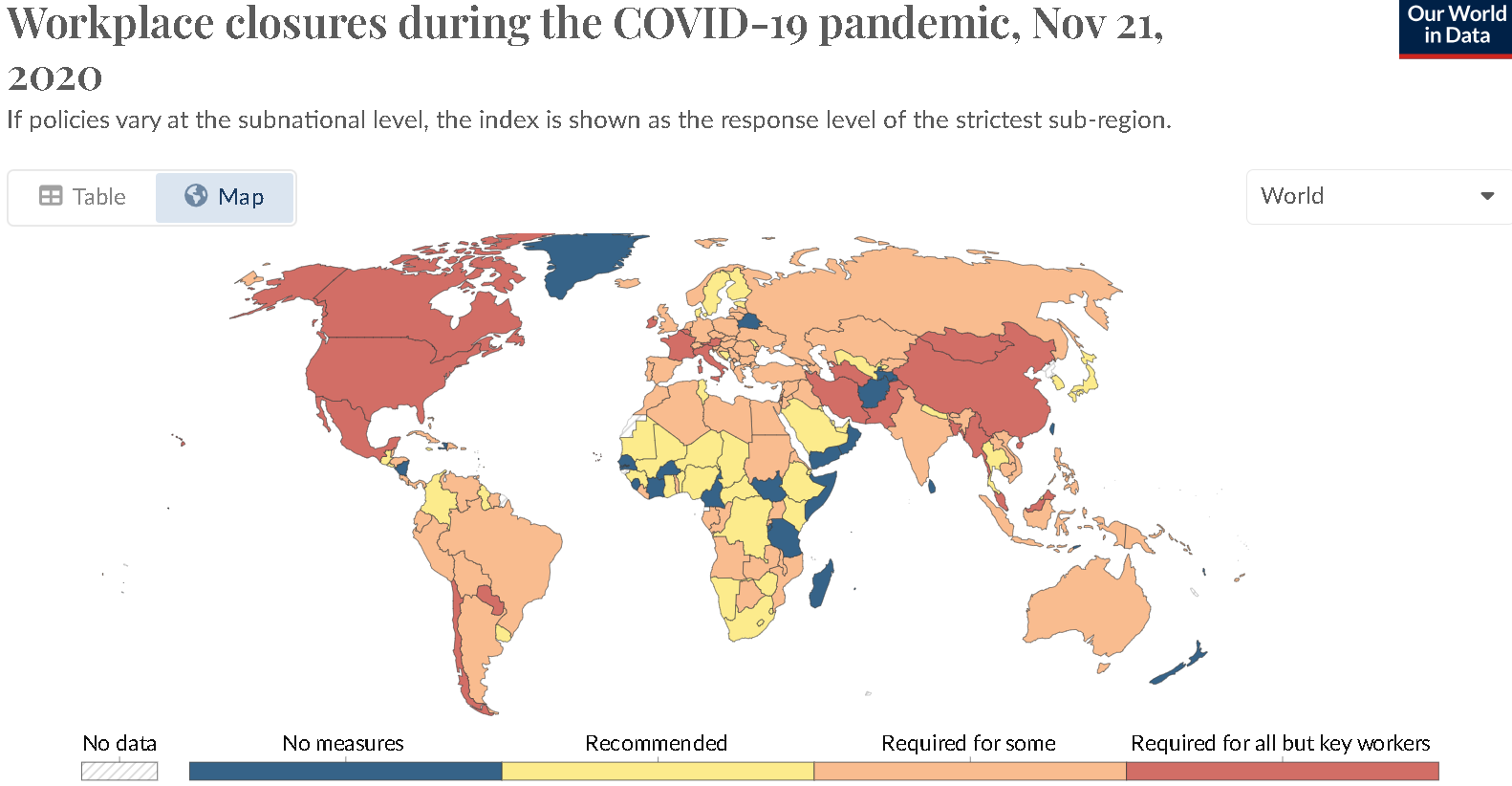

Almost every nation also shut down businesses although many poorer nations could not afford to stop people from working very long. Here is a snapshot of business shutdowns from December 2020 which was almost a year after covid began spreading.

Matthew C. Klein reflected on the pandemic a year and a half after it began:

It would have been weird if a global pandemic that’s shut down large swathes of business activity and has killed more than ten million people worldwide had no economic or financial cost. Yet in most rich countries, [a year and a half later] consumers are richer than before, workers’ wages are higher, and businesses are flush with cash. If most people had known—at the end of 2019—what the body count was going to be and what the current state of the economy would be, they would be amazed at how well things had turned out.

That’s not because the coronavirus has been beneficial, but because policy choices shifted the economic and financial costs of the pandemic…

When the pandemic first emerged in Wuhan, China’s Hubei province experienced an unmitigated economic collapse, with industrial output down by half and homebuilding down by 70%…

According to the the International Monetary Fund’s [October 2021] Fiscal Monitor, the world’s governments spent about $10.8 trillion [with the US leading the way by spending almost half of the global total. Plus governments also added] about $6 trillion in “contingent liabilities” by guaranteeing the obligations of private borrowers and through “quasi-fiscal operations.”

The combined fiscal firepower of the world’s governments was worth about a sixth of global GDP. In the rich countries, it was more like 30-40%… If it hadn’t happened, the economic consequences of the pandemic would likely have been worse than the Great Depression.

In the U.S., the government disbursed so much that the disposable income received by households and nonprofits from March 2020 through August 2021 was 11% higher than in the 18 months ended February 2020. Similarly, nonfinancial corporations generated 7% more in after-tax profits…

Eleven years after Bush implemented the first fiscal stimulus by sending out stimulus checks, Trump did it again, but the checks he sent out were much, much bigger. This time the critics of Keynesian theory were mostly silent even though the stimulus was many times bigger than in 2008. The major US fiscal stimulus acts included:

- $8.3B Emergency funding (March 6, 2020)

- $192B FFCRA (March 18, 2020)

- $2.2T CARES Act (March 27, 2020)

- $484B Paycheck P.P. (April 2020)

- $900B (December 2020)

- $1.9T (March 2021)

This totals $5.68T, but the GAO says the government only spend $4.6T, so evidentially a trillion dollars that was allocated never got spent. That can happen with emergency funding bills as was the case with the $700B TARP program to bail out the banks in 2008 of which only $426B was disbursed and it ultimately generated a small profit and ended up costing taxpayers approximately zero.

In addition, the Fed’s Quantitative Easing (Purchases) in 2020 were about three times bigger than in 2008. Again, whereas the massive monetary stimulus was controversial in 2008, the 2020 stimulus was mostly just accepted as the new normal even though the 2020 monetary stimulus was MUCH bigger. Another difference was that the Fed continued to increase monetary stimulus for six years after 2008 because the initial stimulus was inadequate whereas the fed began reversing the 2020 stimulus just two years later to combat inflation.

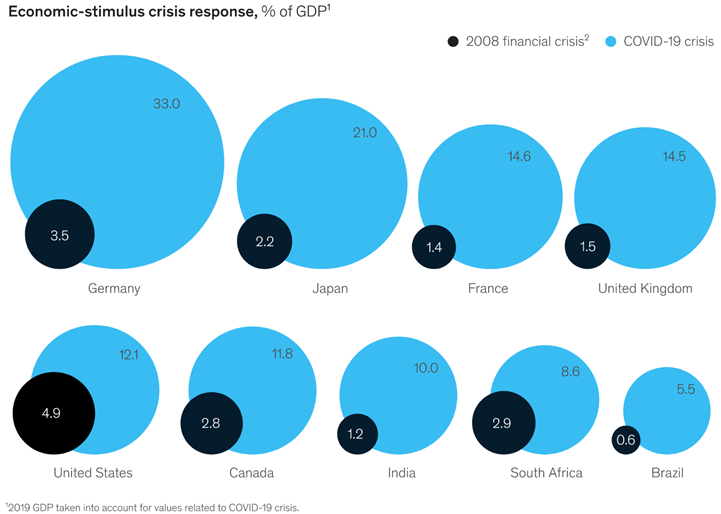

Here is a chart by McKinsey showing the relative size of the fiscal+monetary stimuli during just the first months of the Covid crisis versus the first two years of the 2008 crisis. And the Covid stimulus would still expand much more after this graph was produced!

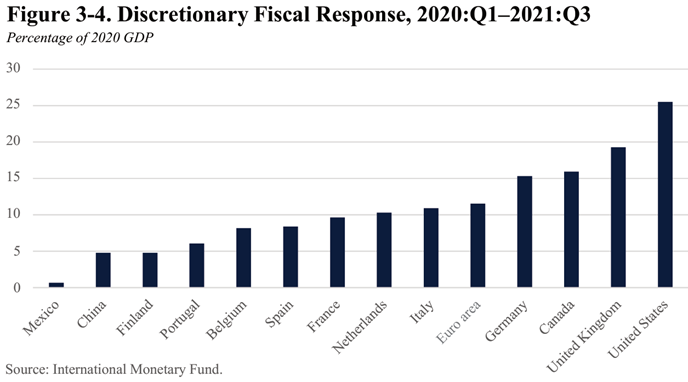

This graph shows just the fiscal stimulus for the first 1.75 years of the pandemic. Both fiscal and monetary stimulus continued after this too.

Source: White House.gov

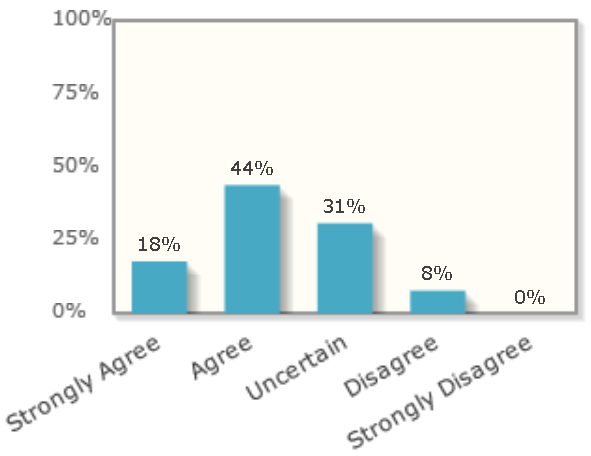

In addition to these demand-side stimulus programs, the Trump administration also promoted efforts to boost aggregate supply: lockdowns, mask mandates, massive vaccine production, and other public health efforts. Many of these efforts were difficult and controversial, but they were mostly supported by economists at the time. For example, here is a poll of elite economists done by the University of Chicago asking, “Will lockdowns reduce economic damage?” The elite consensus at the time was that it was good for the economy.

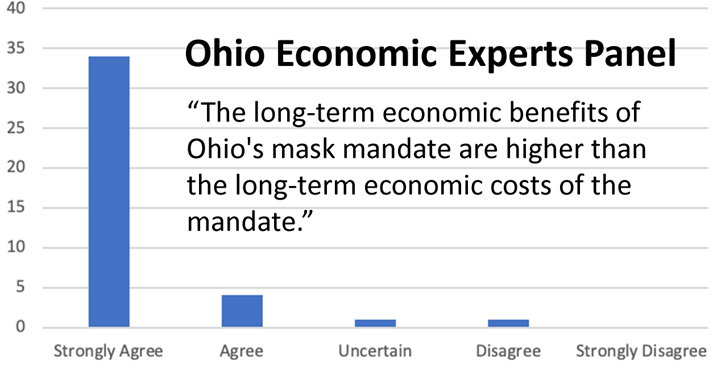

Here is a poll of Ohio economists (including yours truly) about mask mandates:

And the US had the best Covid vaccines earlier than any other nation which helped end the pandemic.

Was the 2020 recession caused by a demand shock or a supply shock?

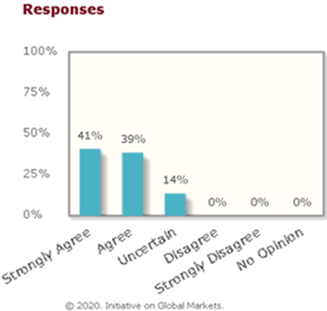

Aggregate demand and supply both contracted during the recession, but the following poll of elite economists shows that that they agreed that the problems “coming from reduced spending [would] be larger than those coming from disruptions to supply”:

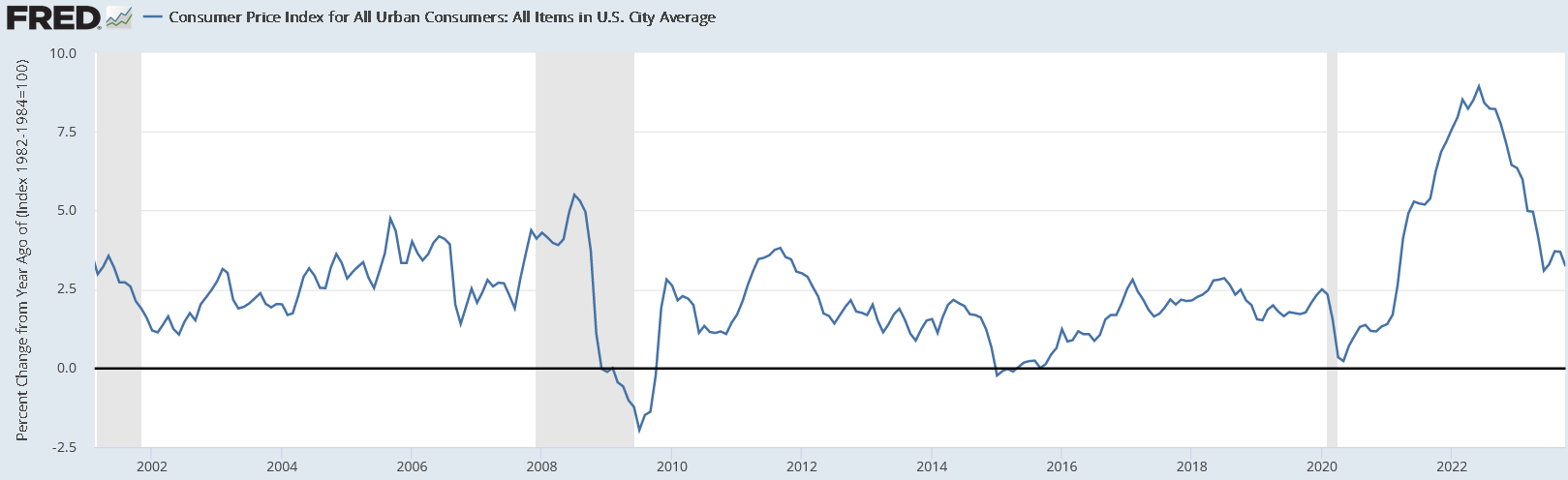

They were right because during the brief recession the US economy nearly experienced deflation which can only be attributed to the demand shock dominating the supply problems.

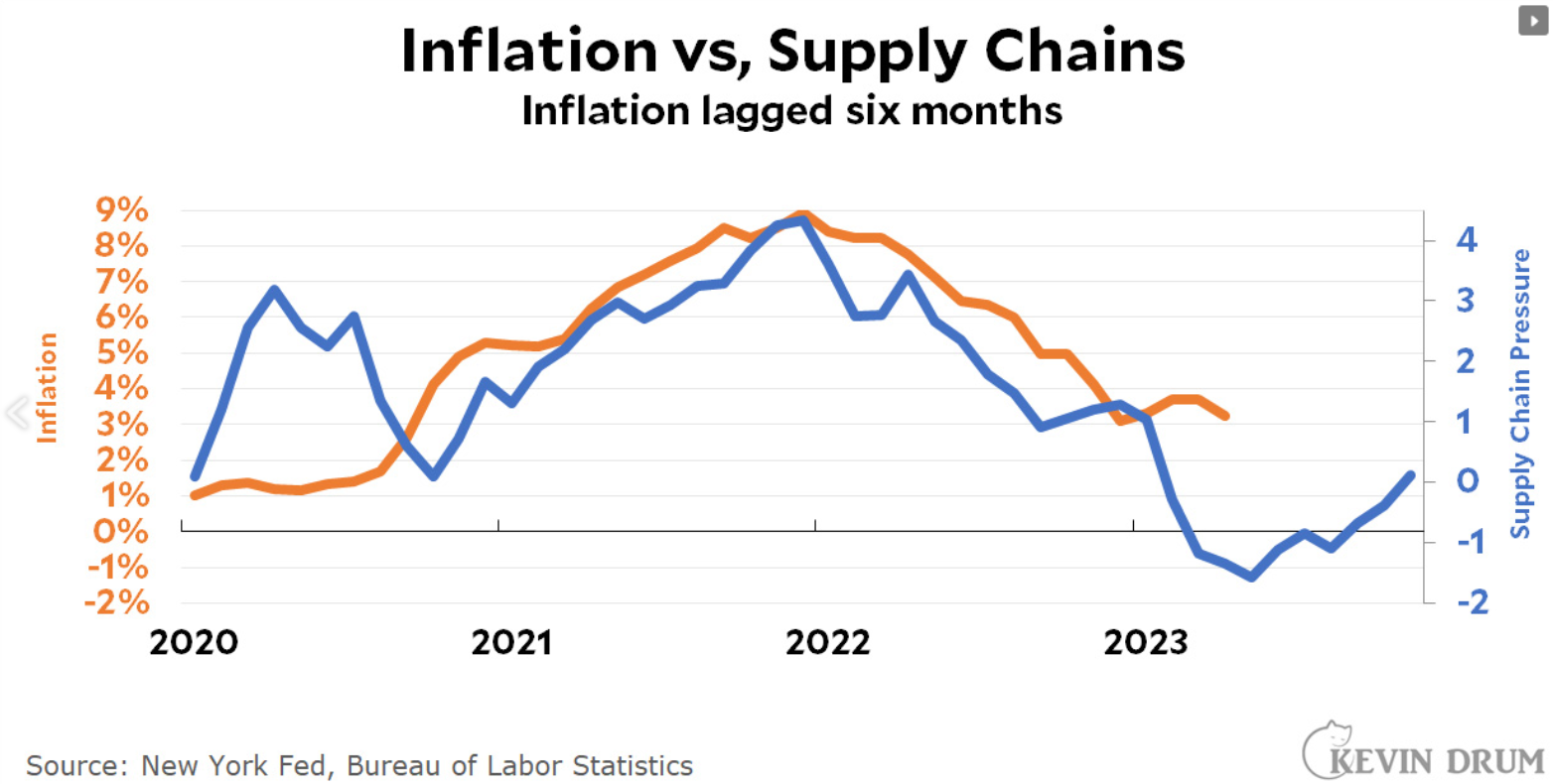

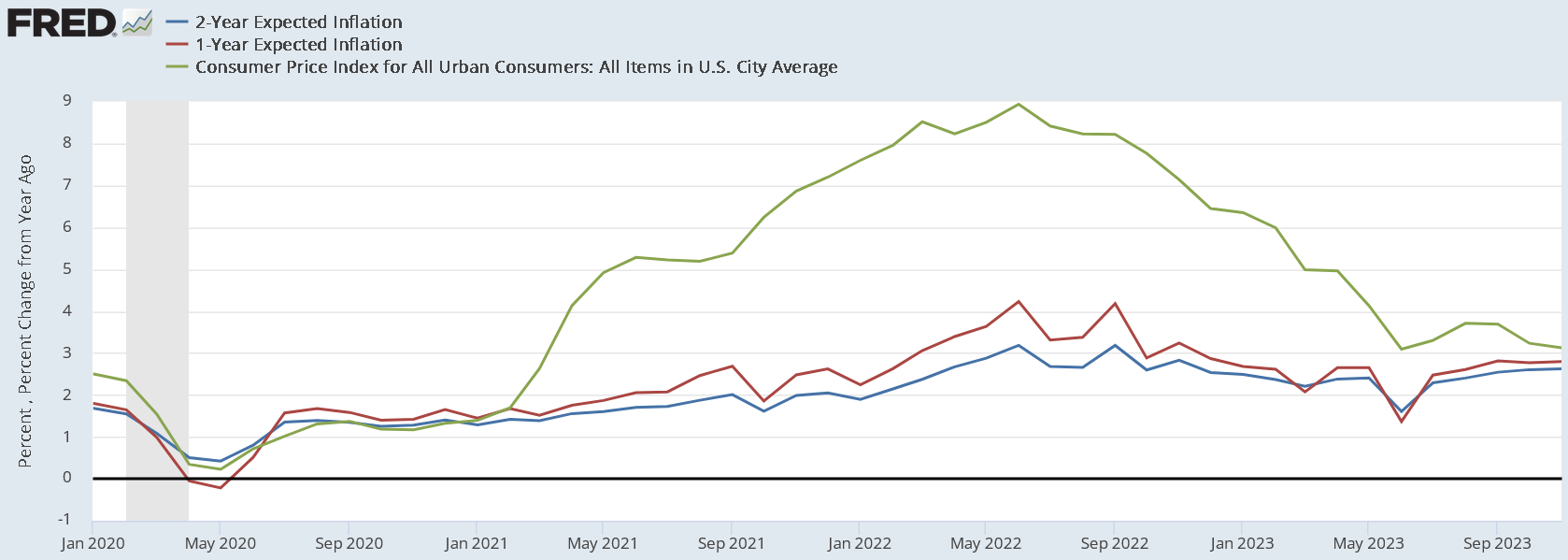

If the supply problems had been bigger than the demand problems, inflation would have risen during the recession (shaded area in 2020 above), but inflation plummeted during the actual recession and, as usual, when the recovery began, inflation immediately started to rise again and then the supply chain problems began to bite. As you can see in the following graph, the supply chain problems in 2020 didn’t cause inflation because demand was even lower than supply, but demand already returned to normal in 2021 which collided with the supply constraints and produced inflation:

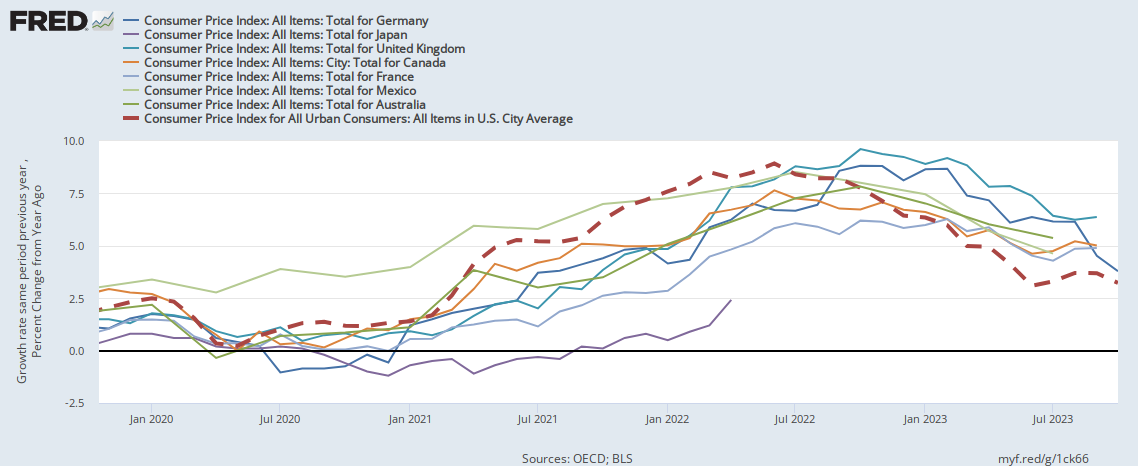

The big debate is whether the stimulus money supercharged spending too much with respect to the new supply constraints. The supply-chain problems produced by the pandemic had reduced the capacity of the economy to produce as much as before the pandemic and inflation started taking off as a result when aggregate demand recovered. Then Russia’s invasion of Ukraine created a second supply shock in 2022 which caused a spike in gas and food prices because Russia was by far the biggest fertilizer exporter and the second biggest energy exporter in the world. Inflation rose in nearly every nation on earth because everyone suffered the same supply constraints even though every country has a different fiscal and monetary policy. It is impossible to know exactly how much of US inflation was due to unavoidable supply problems and how much was due to excessive fiscal and monetary stimulus.

Some economists argue that the high inflation was good for America. For example, the Market Monetarists believe there should always be elevated inflation to help recover after every recession because elevated inflation helps boost output and eliminate unemployment. By their logic, the inflationary US recovery might have been perfect because we want a little extra inflation to get the economy back to normal more quickly.

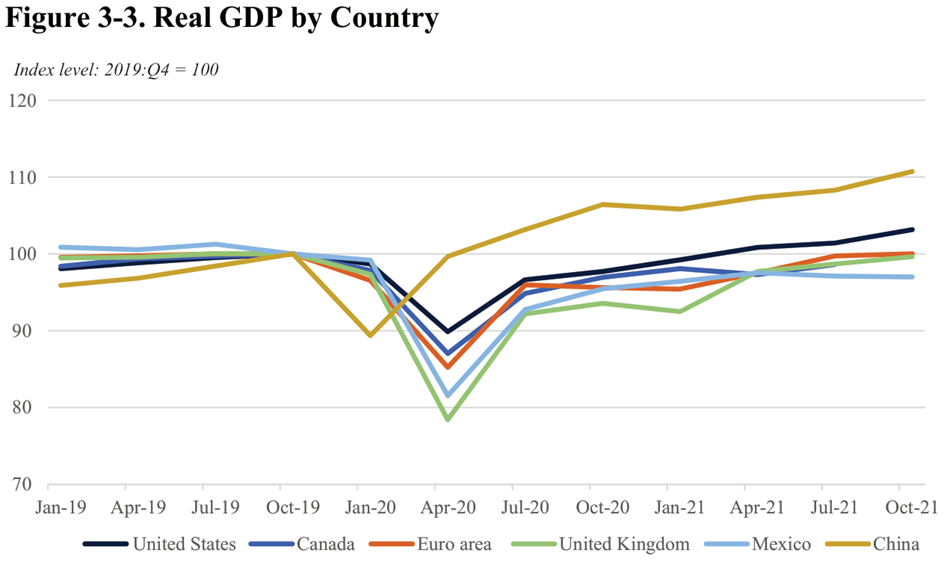

Whereas they argue that fiscal and monetary stimulus was ideal, others argue that America’s high inflation in 2022 demonstrates excessive stimulus. Still others argue that the inflation was inevitable and unavoidable due to the supply chain problems of 2020-23. This debate is unlikely to ever be completely settled, but even if you agree with those who argue that the fiscal and monetary stimulus was excessive, it was better than most other examples we can look at. For example, the 2020 recovery was MUCH, MUCH more successful than the 2008 recovery and the US recovery from 2020 was more successful than other rich nations.

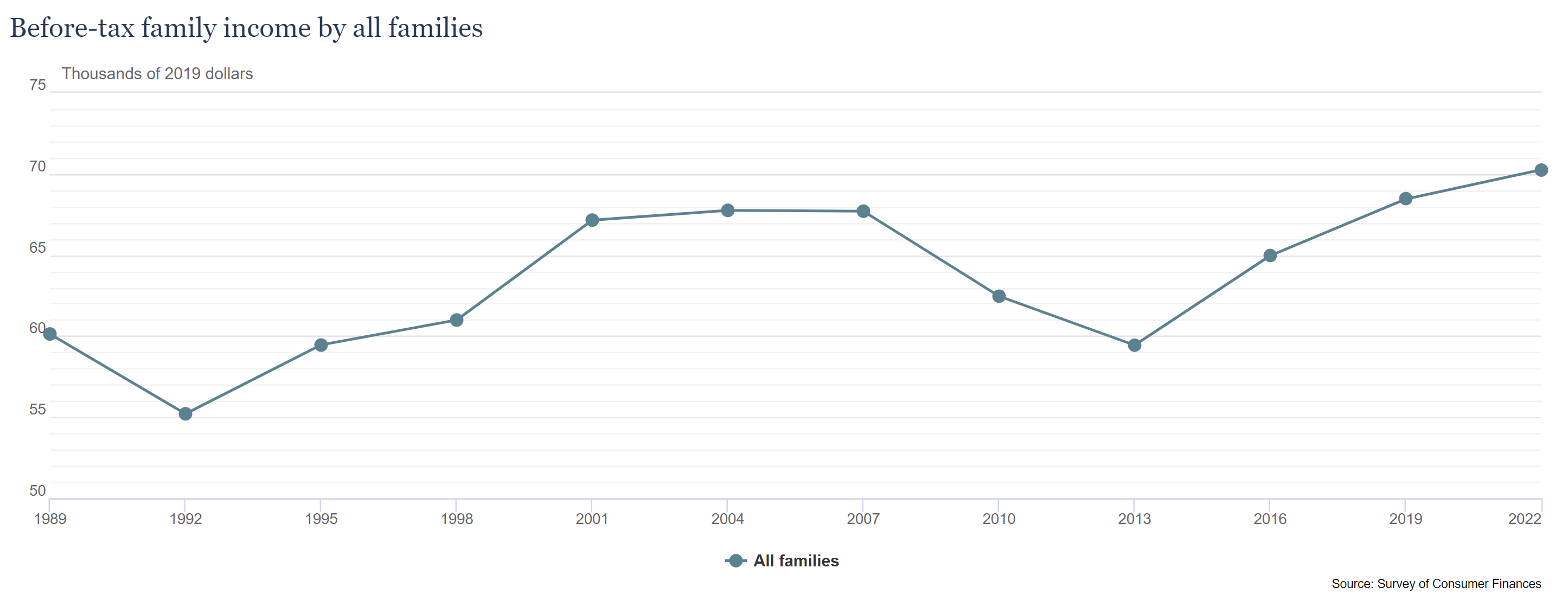

Note that China’s official statistics look better than that of the US, but nobody completely trusts their statistics, and their economy was a basket case in 2022-23, shortly after this graph was produced. Plus real median family income went up, so the increase in US GDP didn’t just go to the wealthy!

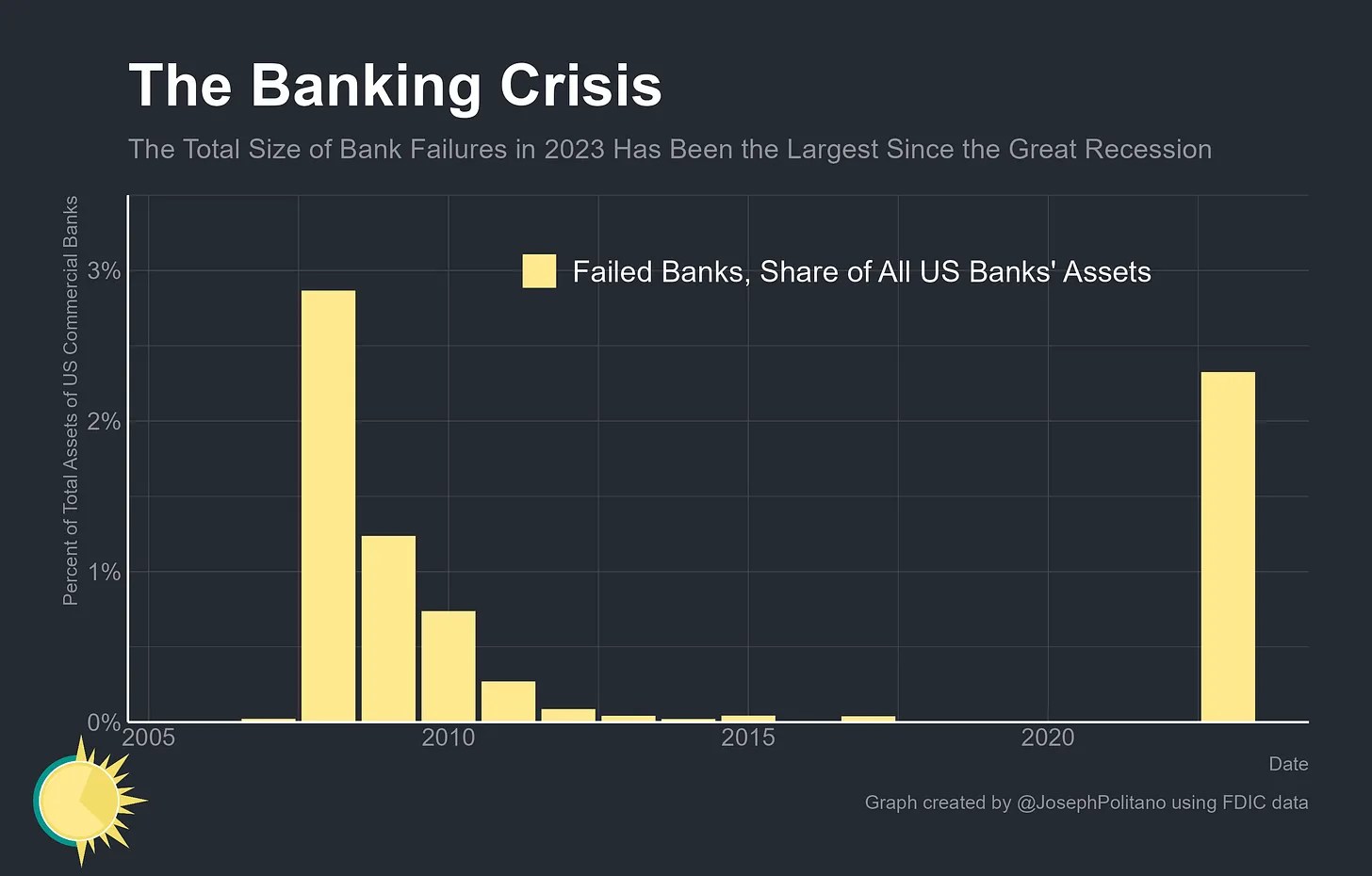

Although the US didn’t suffer as much from the Ukraine was as Europe, the US also had a major banking crisis in 2023 that was managed so well, it had little effect on the overall economy:

Plus, the US inflation rate rose a similar amount compared with other rich nations which indicates that inflation was more of a global phenomenon rather than specific to US stimulus policy (which was bigger than most other nations) and US inflation dropped below most other nations last year so excessive US stimulus must not have been the main cause of our inflation issues and the US has had better growth and now has better inflation than just about any other rich nation.

The Fed would like to claim credit for bringing inflation down, but there two reasons to be skeptical of this hubris.

1. There is a well-documented lag between when the Fed increases interest rates and the subsequent affects on the economy. Most estimates of the lag are at least a year, and the Fed only started raising rates in the middle of 2022, so it is much too early for most of the Fed’s actions to have any affect on inflation yet. We won’t get the full brunt of the Fed’s recent rate hikes until next summer at the earliest.

2. As Kevin Drum says, the main mechanism for rate hikes to reduce inflation is by slowing demand thereby increasing unemployment. This was how it worked in the only other time the Fed brought inflation down by an equivalent amount in the 1980s.

Rate hikes → demand slows → inflation comes down

So far demand has been growing robustly, so there is no reason to believe the Fed caused any of the decline in inflation.

The only other theory for how the Fed could have an effect on inflation is by changing expectations, but there is only very weak evidence for this theory in general and in the present case, inflation expectations never rose much and they have been flat for the past year. So, since inflation expectations have not really changed, they cannot explain why inflation has plummeted.

*My the claim that the first Keynesian fiscal stimulus to fight a recession was in 2008 may seem confusing because there had been many previous fiscal stimuluses. But none of the prior examples were specifically timed to reduce a spike in cyclical unemployment AND used Keynesian logic as a justification. Most of the prior stimuli were either well outside of a recession (like Kennedy’s 1964 tax cut) or not based on Keynesian logic like the massive fiscal stimulus FDR spent for WWII or Reagan’s 1981 tax cut and spending increases which he based upon “supply-side” theory. The core idea of Reagan’s “supply side” justification was the same as Kennedy’s who also argued that the government would increase tax revenues by decreasing tax rates! The “supply side” theory was promoted as an alternative to Keynesianism. Keynesians argue that a tax cut ONLY stimulates the economy during recessions whereas the supply siders believed tax cuts always stimulate the economy regardless of the level of unemployment. Furthermore, in Keynesian theory, a fiscal stimulus only works if there is excess hoarding of money. That is the root cause of a typical recession. A fiscal stimulus only works because the government borrows that excess money and puts it back into the economy. When the economy is operating at full employment, Keynesians argue that deficit spending should be cut (by raising taxes and/or cutting spending) to help reduce inflation and free up private savings to be lent to businesses for their expansion and thereby increase aggregate supply.

Leave a Comment