Update: 2018

Presidential candidate Ted Cruz wants to return to the gold standard. Is there is enough gold to do so? The short answer: Yes, there is enough gold in the world to go back on a gold standard, but it would require a huge sacrifice.

First of all, there is nothing stopping anyone from using pieces of gold to pay for all your shopping right now if you want to. It is just that that pieces of gold are much less convenient than credit cards, checks, or even cash. It would be impossible for everyone to use pieces of gold as money because there is too little gold in the world to directly use as a commodity money. That was always a problem with using gold as money, so under the “gold standard” almost nobody ever actually used gold as money. Instead, everyone mostly used paper money and checks. In theory that paper money could have been exchanged for metallic gold at a fixed exchange rate, but in practice, there was never enough gold held in bank reserves to cover all the bank deposits and paper money in circulation. As Joshua Greenberg points out, there was never enough gold to manage all the economic transactions people wanted to make, so banks created paper money that was more plentiful and convenient than gold. The banks made a “promise” that the paper money was “backed” by gold, but that was always a bit of a lie. In reality, paper money was mostly just created out of thin air with the hope that only a small percentage of it would ever be redeemed for gold because if more than a tiny percent of the money were to be redeemed for gold, it would cause a bank run that would collapse the monetary system.

Today, all money is 100% fiat money that is created out of thin air and this is more honest than the fiction under the gold standard that money was based on gold. Only a tiny fraction of the money was ever based on gold. One problem with returning to a gold standard is that it would require raising taxes because the government would have to buy a massive amount of gold in order to base our monetary system on gold again.

Whereas under our fiat system, the government makes a profit from creating money and that helps reduce taxes, under a gold standard, the government would have to raise taxes to buy gold just to increase the monetary base and that is only a small part of the sacrifice of going on a gold standard. I would rather that our taxes buy useful services and produce public goods rather than buying gold that is destined to sit idly in government vaults as a monetary base when fiat money can be produced for free.

The crucial problem of a gold standard is the same as the problem of bitcoin as a monetary base. The quantity is basically fixed and as the economy grows and requires more money, the money supply cannot grow with the economy. Charles Wheelan likens it to a poker game that started decades ago with five players and fifty chips. If there are hundreds of tables playing poker later due to a growing economy, but still only 50 chips, the monetary system breaks down.

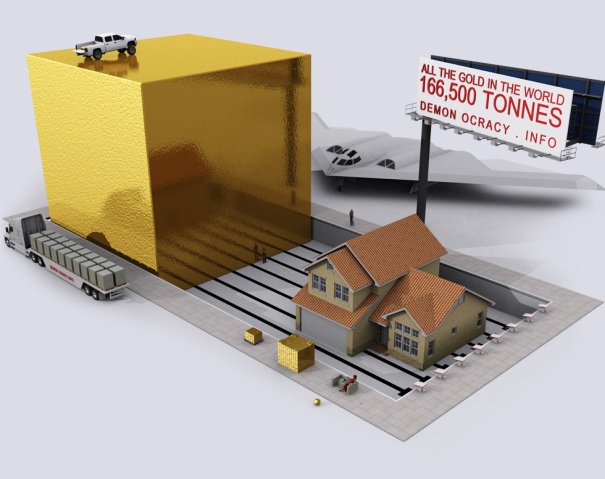

How much gold is there in the world? According to BBC, there are about 171,300 tonnes of gold in the world. If melted down into a cube, it would only be about 20.5m (22 yards) long! Visual Capitalist shows how big that would look compared with some vehicles, a house or an olympic swimming pool. If it were melted down into the pool, it would fill a bit more than three swimming pools.

At a current price of under $1,100/oz, the total value of all the gold in the world is about $6 trillion. In comparison, the monetary base of the US alone is $3.9 trillion, so if the US were to go back on the gold standard, we would need to buy over half of the world’s gold to fully back the US monetary system at current prices. In 2018, the US government gold reserves were only worth about $11 billion, so the US Treasury would have to more than double Federal taxes for a year just to pay for enough gold to use as reserves.

On the other hand, the US monetary base was inflated by quantitative easing beginning in 2008 and in normal times, the US monetary base might only be about $1 trillion. And the monetary base of the EU is $1.7 trillion. Thus, in normal times there would be enough gold in the world for both the US and the EU to go back on the gold standard. But the US has only 16% of world GDP and the EU has 17%, so the entire world could not fully base the world’s economies using gold as 100% of the global monetary base at the current gold price even if the governments of the world somehow managed to buy all of the gold away from private owners.

Nevertheless, there are three ways it would still be possible for the entire globe to adopt a gold standard. First, governments rarely if ever fully funded their monetary base with gold. For example, the US generally only kept less than half of its monetary base in gold. Under-funding the monetary base would help make a global return to the gold standard feasible, but it also makes a gold standard less stable because it causes financial panics when people start exchanging their paper money for actual gold thus further depleting the monetary base. When people know there isn’t enough gold for everyone and only the first people to exchange money for gold will actually get the gold, there are periodic bank rushes which cause economic collapses. The last time this happened was the Great Depression when the gold standard system collapsed for good (although gold was still used to help managed the fixed exchange rate system after WWII through about 1970 as will be explained shortly).

Secondly, and most importantly, if the governments of the world started buying up the world’s gold to run our monetary systems, it would dramatically increase the price of gold which would reduce the tonnes of gold that would be needed for running the global monetary system.

Under the gold standard, an increased demand for money would literally create more monetary base out of thin air by raising the value of gold. That would be great for the world’s gold producers who are constantly lobbying for a return to the gold standard, but it would be a tremendous waste to have to raise taxes to buy all the necessary gold. A return to the gold standard would dramatically increase the wealth of people who are already hoarding a lot of gold.

The massive increase in the demand for gold for use as the monetary base would suck up most of the world’s gold supply and cause the price to skyrocket which would be bad for industries that need gold to make things such as electronics and jewelry. I’d speculate that the price of gold might skyrocket up to $10,000/oz (from under $2,000 today) because of all the gold that governments would have to buy. And they would just waste it because it would all get hoarded in central bank vaults.

In fact, under the gold standard the US government got so desperate for gold that it banned the private ownership of gold. For example, the US banned the private ownership of gold from 1933 to 1974 because the government felt it needed to monopolize the entire stock of gold just for managing foreign exchange policy. This wasn’t a true gold standard because money must be interchangeable for gold under the true gold standard, and if people can’t own gold, then there is no point in saying that a dollar is worth a certain amount of it. But the US government let foreign governments exchange dollars for gold during this period (in theory at least) which meant that the US foreign exchange system was still on the gold standard.*

The third mechanism by which the world could go back onto the gold standard is to simply reduce the amount of money in the economy which would cause the value of money to rise (also known as deflation). Under the gold standard, government monetary authorities regularly engineered deflations partly for this reason. A deflation is a drop in the prices of everything except money which rises in value. When the money supply cannot grow as fast as the economy grows, deflation is necessary to adjust prices downward due to the equation: MV=PY. Alternatively, if the amount of gold reserves shrinks for some reason such as high net imports of goods and services that are paid for with gold, a deflation is necessary to rebalance the monetary system. In fact, one of the main problems with a gold standard is that it tends to force periodic deflations which causes recessions that would be completely avoidable under any modern monetary system.

*Nearly the entire world had to suspend the gold standard during the Great Depression and World War II because that is what always happens under the gold standard during an economic crisis. By the end of the war the US had accumulated 2/3 of the entire global stock of gold. Thus, it would have been very difficult for anyone else to go back on the gold standard at that point because they would have had to buy lots of gold from the US and their war-torn economies didn’t have resources to spare. Instead, most of the world’s economies adopted the Breton Woods system for monetary policy in which the US pledged to fix the value of the US dollar to 1/35 an ounce of gold and all the other nations agreed to fix their currencies to the dollar.

The rest of the world effectively went on the dollar standard while the US kinda held to the gold standard for foreigners only! Americans were banned from buying gold or even keeping their old stocks of gold except for limited amounts in the form of jewelry, rare old coins, or amounts that were going to be immediately consumed for industrial purposes. This Breton Woods system was a way for the world to kinda go back onto a foreign-exchange version of the gold standard with an even smaller amount of gold in reserves than would have been needed for a full gold standard, because the gold was only used to fix foreign exchange rates and only had to be enough to back foreign exchange transactions. But as global trade increased, the monetary base got more leveraged and the more leverage there is, the less stability. The system collapsed in the early 1970s and hardly anybody has succeeded in going back on any kind of gold standard since then.

One brief exception was when OPEC briefly tried to stop pricing oil in dollars when the dollar was decoupled from the price of gold in the 1970s and started pricing oil using gold for a short time, but they soon found it more convenient to price oil in dollars and returned to their previous practice.

Actually, Richard Cooper shows that the gold standard itself was a very brief part of monetary history. “The international gold standard proper dates only from the 1870s. It lasted until 1914, and then had a brief revival in the late 1920s.” It came about by an accident of history when Sir Isaac Newton made a mistake in managing the bi-metalic monetary system in Britain in 1717 and overvalued gold relative to silver. That caused ordinary people to favor gold and eventually Britain officially abandoned silver altogether during the Napoleonic wars in the early 1800s. Then as Britain’s economy grew, the rest of the developed world started to copy it’s gold-standard system partly in order to facilitate trade with the British Empire. But the system fell apart in WWI and again during the Great Depression. So although gold has always been valuable, it was only commonly used as a basis of monetary systems for a fairly brief window in the history of civilization.

Leave a Comment